The Importance of Year-End Accounts

As the fiscal year draws to a close, small businesses are gearing up for the essential task of wrapping up their financial affairs. Beyond being a regulatory obligation, the year-end accounts offer a comprehensive snapshot of a company’s financial health. According to a recent survey by the Small Business Administration, 40% of businesses that fail cite financial mismanagement as a primary reason. With this statistic in mind, it becomes evident that meticulous year-end accounting is not merely a box-ticking exercise but a strategic necessity for the survival and growth of small enterprises.

Taking Stock of Financial Health:

At the heart of year-end accounting lies the opportunity for small businesses to take stock of their financial health. This involves a meticulous review of profit and loss statements, balance sheets, and cash flow statements. By scrutinizing these financial documents, businesses can identify trends, assess the effectiveness of their financial strategies, and make informed decisions for the upcoming year. Beyond regulatory compliance, this introspective process serves as a compass, guiding businesses towards sustainable growth.

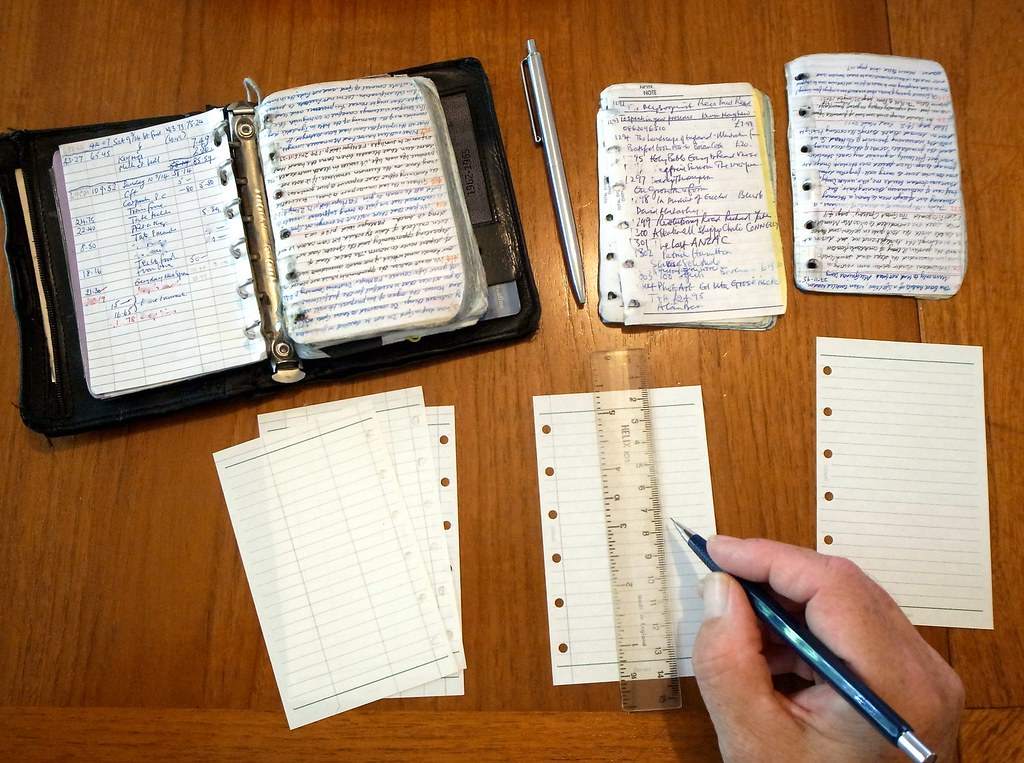

Efficient Record Keeping Throughout the Year

The process of year-end accounting is significantly streamlined when small businesses adopt efficient record-keeping practices throughout the year. A staggering 82% of small business owners struggle with inconsistent cash flow, according to a recent study by the National Small Business Association. Implementing a robust record-keeping system can alleviate this challenge and provide a real-time understanding of a business’s financial position.

Utilizing Accounting Software:

Investing in user-friendly accounting software can be a game-changer for small businesses. These tools automate many aspects of financial record-keeping, from invoicing to expense tracking, reducing the likelihood of errors and ensuring that financial data is up to date. Cloud-based solutions also offer the advantage of accessibility, allowing business owners to review financial information anytime, anywhere. Integrating such software into daily operations not only enhances efficiency but also facilitates a seamless transition into year-end accounting processes.

Reviewing and Updating Expenses

Year-end accounting presents an opportune time for small businesses to thoroughly review and update their expenses. The U.S. Small Business Administration reports that 50% of small businesses fail within the first five years, with financial mismanagement as a leading cause. Scrutinizing expenses can help identify unnecessary costs, optimize budget allocation, and contribute to overall financial resilience.

Expense Audit and Cost-Cutting Strategies:

Conducting a detailed expense audit involves categorizing and analyzing all expenditures. This process helps in identifying areas where costs can be trimmed without compromising productivity or quality. Small businesses should also explore cost-cutting strategies, such as renegotiating contracts with vendors or seeking out more affordable alternatives. By addressing unnecessary expenses, businesses can enhance their bottom line and enter the new fiscal year with a more sustainable financial structure.

Strategic Tax Planning

Small businesses can significantly benefit from strategic tax planning during year-end accounting. The U.S. Chamber of Commerce reports that tax-related issues are a top concern for 82% of small businesses. Understanding tax implications, exploring deductions, and ensuring compliance can result in substantial savings, bolstering a business’s financial foundation.

Maximizing Deductions and Credits:

Business owners should work closely with tax professionals to identify and maximize available deductions and credits. This may include expenses related to equipment purchases, employee benefits, or research and development initiatives. Leveraging these opportunities not only reduces the tax burden but also supports overall financial goals. Additionally, businesses should ensure compliance with any changes in tax regulations to avoid penalties and legal complications.

Employee Payroll and Compliance

Managing employee payroll and ensuring compliance with labor regulations are integral aspects of year-end accounting for small businesses. According to a report by the National Small Business Association, 60% of small businesses struggle with complex employment laws. Accurate payroll processing and compliance not only mitigate legal risks but also contribute to a positive workplace culture.

Reviewing Payroll Records:

Small businesses should meticulously review payroll records to ensure accuracy and compliance with labor laws. This includes confirming that employee classifications are correct, overtime is accurately calculated, and all necessary tax withholdings are executed. Businesses should also be aware of any updates or changes in labor regulations that may impact payroll processes and adjust their procedures accordingly. Taking the time to address payroll concerns during year-end accounting fosters transparency and trust among employees.

Assessing Inventory and Asset Values

For businesses involved in the sale of physical goods, year-end accounting is an ideal time to assess inventory and asset values. Proper valuation ensures accurate financial reporting and can impact tax liabilities. The Small Business Administration notes that mismanagement of inventory contributes to the failure of 46% of small businesses. Therefore, a thorough evaluation of inventory and assets is crucial for maintaining financial health.

Conducting Inventory Audits:

Performing regular inventory audits throughout the year is essential, but year-end provides an opportunity for a comprehensive review. Businesses should compare physical inventory counts with recorded values to identify any discrepancies. This process aids in preventing overstocking or stockouts, optimizing cash flow, and identifying slow-moving or obsolete inventory that may need adjustment.

Debt Management and Credit Assessment

Managing debt is a key aspect of year-end accounting for small businesses. According to the National Small Business Association, 29% of small businesses struggle with high levels of debt. Evaluating outstanding loans and lines of credit is crucial for optimizing financial health and positioning the business for future growth.

Reviewing Debt Structure:

Small businesses should review their existing debt structure, including outstanding loans, interest rates, and repayment terms. Assessing the impact of debt on cash flow and overall financial stability helps in making informed decisions. It may involve renegotiating terms with creditors, consolidating debt for better interest rates, or developing a repayment strategy that aligns with the business’s financial goals.

Future Financial Planning and Goal Setting

As businesses wrap up their year-end accounting, it’s essential to shift focus towards future financial planning and goal setting. According to a study by the National Federation of Independent Business, 39% of small businesses lack a financial plan. Establishing clear financial goals and a strategic plan for the upcoming year sets the stage for growth and success.

Setting Realistic Financial Goals:

Small businesses should set realistic and measurable financial goals for the next fiscal year. Whether it’s increasing revenue, expanding market share, or improving profit margins, having specific objectives provides a roadmap for decision-making and resource allocation. Additionally, developing a contingency plan for unforeseen challenges ensures adaptability in a dynamic business environment.

The year-end accounting process is not just about meeting regulatory requirements; it’s a holistic approach to evaluating, optimizing, and planning for the financial well-being of a small business. By addressing aspects such as inventory valuation, debt management, and future financial planning, businesses can navigate year-end accounting with a proactive mindset, positioning themselves for sustained success in the ever-evolving business landscape.

Frequently Asked Questions (FAQ)

- Why is year-end accounting important for small businesses? Year-end accounting offers a comprehensive view of a business’s financial health, aiding in strategic decision-making, regulatory compliance, and overall fiscal responsibility.

- How can small businesses streamline record-keeping throughout the year? Utilizing accounting software, maintaining organized documentation, and conducting regular financial check-ins can contribute to efficient year-end accounting.

- What are some effective cost-cutting strategies during expense review? Businesses can renegotiate vendor contracts, explore more affordable alternatives, and eliminate unnecessary expenses to optimize their budget.

- Why is strategic tax planning crucial for small businesses? Strategic tax planning helps businesses identify deductions, credits, and compliance measures that can result in significant savings and legal adherence.

- What steps can businesses take to ensure compliance with employee payroll? Regularly reviewing payroll records, staying informed about labor regulations, and working with professionals can help ensure accurate payroll processing and compliance.

- How can businesses assess inventory and asset values effectively? Conducting regular inventory audits, comparing physical counts with recorded values, and adjusting for any discrepancies are essential for accurate financial reporting.

- What should small businesses consider when managing debt and assessing credit? Reviewing existing debt structures, negotiating terms with creditors, and developing a clear repayment strategy are key elements of effective debt management.

- Why is future financial planning important for small businesses? Establishing clear financial goals and a strategic plan for the future provides businesses with a roadmap for growth and adaptability in a dynamic business environment.